Table of Contents Show

A bear hug is a financial term that refers to a hostile takeover tactic so generous that shareholders are more likely to accept it than refuse it.

This substantial offer is given to outperform the competition and make it difficult for the company to refuse the request.

This method of a hostile takeover is standard in the finance industry, especially if your company has other competitors interested in the purchase.

To learn more about bear Hug finance, the examples, and some pros and cons, keep reading.

Related: Pac Auto Finance | Full Company Profile

What is a Bear Hug Finance? | Definition of Bear Hug Finance

A takeover method known as a bear hug or teddy bear hug occurs when the acquiring business offers a larger purchase price than the target company’s existing value.

The target firm is refusing to sell. Hence, a higher price is being offered under this purchase.

The target business cannot easily walk out of the agreement because of this purchase.

The bear hug takeover technique is designed to avoid more aggressive takeover techniques and to lessen or altogether remove any rivalry for the same target company.

Although bear hugs result in profitable outcomes for the stockholders, they are frequently unexpected and unwelcome.

Bear Hug: What the Concept Means

Understanding the term bear hug is actually a simple concept. The idea is that the target firm feels suffocated by a bear hug, which is a hostile acquisition because it is a friendly approach from the other side.

It seems as though a bear has gripped you so tightly that you have no other choice than to flee.

The purchasing corporation has seized (covered) the target company from all sides, leaving little opportunity for escape, and the target business is in a similar predicament.

Therefore, such an act of acquisition is a bear hug.

Related: Driveways On Finance Near Me | Best Driveway Finance Companies in 2023

What are the Relatable Examples of Bear Hug Finance?

The following are relatable examples of bear hug finance:

#1. Microsoft and Yahoo

One instance of a bear hug deal was when Microsoft wanted to buy Yahoo and offered Yahoo the chance to purchase its shares at a 63% premium over the previous day’s closing price.

The stockholders appeared to benefit from this since Yahoo was having trouble, and their company was suffering significant losses.

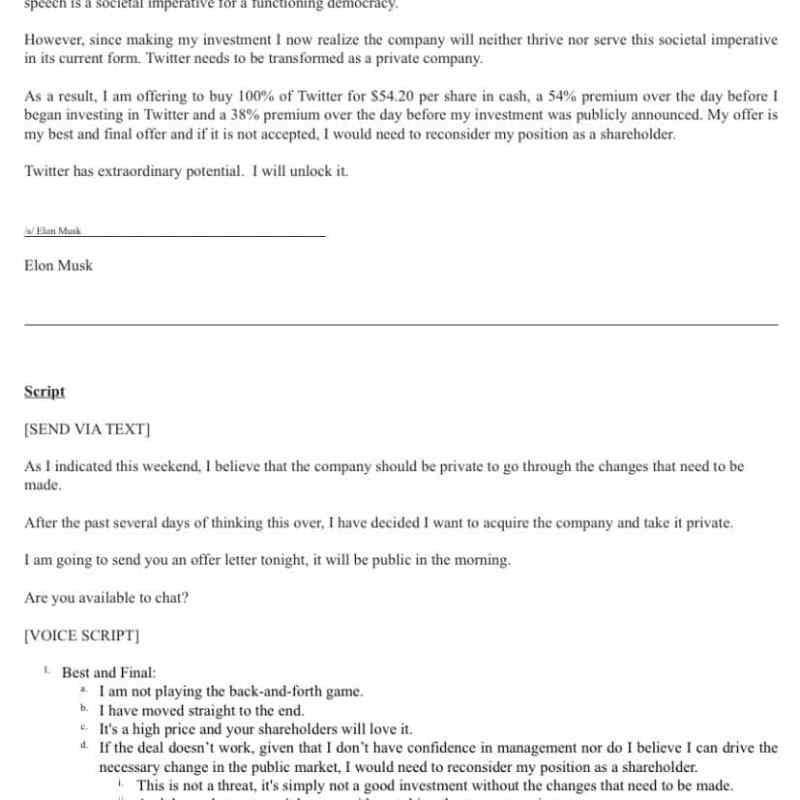

#2. Twitter and Elon Musk

Elon Musk’s purchase of Twitter (TWTR) in April 2022 for 44 billion USD, or 18% more than its market value, was a bear hug.

#3. Xerox and Hp

The pursuit of HP (HPQ) by Xerox (XRX) in 2019 is a good example of a bear hug.

The Silicon Valley pioneer HP Inc. had previously attempted a hostile takeover by the Board of Xerox Holdings Corp for a total price of $33.2 billion, an 18% premium, making it the sixth largest tech purchase ever.

Related: You Can Get a Cashier’s Check Without a Bank Account | See How

#4. Facebook and Whatsapp

Facebook revealed its plans to buy Whatsapp in February 2014 and offered a significant offer.

They ultimately paid $19.6 billion for WhatsApp despite the fact that the company’s founders had requested a $16 billion purchase price.

A part payment of the $19.6 billion was paid in cash, and another component was issued as Facebook shares.

Whatsapp could not reject Facebook’s bid to buy it, which made it one of the most significant acquisitions in US history.

What are the Pros and Cons of a Bear Hug Finance?

If practical, a bear hug has the power to divert management and directors of the targeted organization, ultimately harming the company’s business and all stakeholders, including the bear hugger.

A bear hug calls attention to the company’s present management and shares price, either directly or indirectly.

Advantages of a Bear Hug

Here are a few of the benefits:

- It aids the business in acquiring supplementary goods and services and broadens its market reach.

- The stockholders benefit most from it since they may sell their firm stock for a higher price.

- When the target company is eager to be bought, it helps to reduce market rivalry.

- The target company could receive incentives from the purchasing company to ensure the takeover is successful.

Disadvantages of Bear Hug

- As the acquiring business takes control of the operations, the current management may lose control over management decisions.

- If the target company doesn’t perform well later despite paying a more fantastic price, it could end up being expensive.

- The purchased firm is constantly under pressure to demonstrate its return on investment.

Related: Crane Finance Loan Reviews | Is Crane Finance Legit?

Why Bear Hug Finance?

Bear hugs are seen as aggressive takeover tactics, but because they are far more financially advantageous to shareholders, it is difficult for the target business to reject one.

Here are some of the reasons why bear hugs are preferred

#1. It Reduces the Competition

Bear hug proposals are generally made to organizations that are in financial distress, have significant debt, or are untested startups.

This isn’t always the case, though. There are probably several prospective bidders when it is known to the public that a firm is looking to be bought.

The target firm will be acquired by the prospective purchasers, but obviously at the best price.

As a result, they help the target firm overcome the competition in situations when the acquisition is inevitable due to the price that is being given, which is far greater than the market price.

The possibility of a higher share price being offered benefits shareholders of a firm receiving a bear hug.

Even if it doesn’t result in a speedy agreement, a bear hug puts a lot of pressure on a company’s management and board of directors to raise the share price from what the bear hugger is willing to provide.

Related: Should You Borrow From Redwood Coast Finance

#2. To Avoid Further Negotiation and Confrontation with the Target Company

When the target company is hesitant to accept the acquisition offer, businesses may choose this tactic.

As a result, the alternate strategy to winning over the shareholders is to embrace the acquisition when the acquiring business provides a price that is too good to pass up.

What Happens if a Bear Hug Letter is Rejected?

Although bear hugs are often so juicy that it might be difficult for the target company to reject the offer, however, there is no guarantee that this tactic is 100% effective at all times.

Sometimes bear hugs are rejected, and in this case, the target company might even get sued.

Here are some of the things that can happen if a bear hug is denied.

A company’s Board of Directors is legally bound to act in the best interests of its shareholders.

Thus management is unlikely to be able to reject an offer that adds such significant value to the company.

However, in the case of bear hug rejection, the shareholders might sue the Board of directors on the basis that they lost an excellent opportunity to make a considerable profit from the offer.

If they cannot justify the reasons behind the rejection, they might face serious litigation.

Related: Morry Rubin Finance | All You Need to Know About Morry Rubin

If the Board of directors rejects a bear hug, the purchasing company can decide to approach the shareholders individually directly.

The shareholders are offered an amount higher than the current market price of their shares.

These offers are mostly so juicy that it will be difficult for shareholders to turn them down.

In this situation, the purchasing company will purchase all individual shares until it becomes the owner of the highest percentage in the company and the owner.

However, the method might be tedious and time-consuming and is only implemented if the purchasing company has a serious interest in the business it wants to purchase.

What is a Bear Hug Letter?

A bear hug letter is a letter outlining the offer that is sent to the management or Board of directors of the target firm.

High-profile takeover efforts could be made public if they are disclosed.

Related: Idaho Housing and Finance | Find Rental Assistance, Rates, Payment & Jobs

Example of Bear Hug Letter

Here are some samples of Bear hug Letters to Twitter before it was taken over by Elon Musk.

What is the Difference Between Bear Hug and Poison Pill?

The bear hug is a hostile attack on targeted companies to purchase it at a price higher than the current market offer.

This offer is often irresistible that the Board of directors and shareholders might find it difficult to resist.

However, the poison pill is like a counterattack from the company to be purchased.

This reaction method is often used to make the company so undesirable that it won’t be under siege in a bear hug.

This method is only implemented if the company doesn’t want to purchase.

This poison pill might be serious hype in price that the bidding companies will get discouraged.

Conclusion

In conclusion, the bear hug hostile takeover method has proven effective in some scenarios.

However, in some cases, it doesn’t yield so many results.

FAQs On Bear Hug Finance

#1. What are the risks of bear hug finance?

A bear hug is a hazardous tactic for the purchasing corporation because it may take some time before there is a return on the investment.

There is no assurance that the target business will realize enough value to justify the bear embrace.

If the target firm rejects the offer, the company’s decision may not be in the best interests of its shareholders.

#2. Why is it called a bear hug?

Understanding the term “bear hug” is actually a simple concept. The idea is that the target firm feels suffocated by a bear hug, which is a hostile acquisition because it is a friendly approach from the other side.

It seems as though a bear has gripped you so tightly that you have no other choice than to flee.

#3. Is Bear Hug a hostile takeover?

Yes, a “bear hug” takeover is a form of a hostile takeover. This type of purchase makes it difficult for the board of directors to make contrary decisions.

A hostile takeover is a situation where the target company is purchased against its will.

FAQs

What are the risks of bear hug finance?

A bear hug is a hazardous tactic for the purchasing corporation because it may take some time before there is a return on the investment.

There is no assurance that the target business will realize enough value to justify the bear embrace.

If the target firm rejects the offer, the company’s decision may not be in the best interests of its shareholders.

Why is it called a bear hug?

Understanding the term “bear hug” is actually a simple concept. The idea is that the target firm feels suffocated by a bear hug, which is a hostile acquisition because it is a friendly approach from the other side.

It seems as though a bear has gripped you so tightly that you have no other choice than to flee.

Is Bear Hug a hostile takeover?

Yes, a “bear hug” takeover is a form of a hostile takeover. This type of purchase makes it difficult for the board of directors to make contrary decisions.

A hostile takeover is a situation where the target company is purchased against its will.

References

- Smartcompany – Bear hugs: The new hostile takeover

- Fincash – Bear Hug Meaning in Business.